County property tax value assessments have been released! Any increase impacts your monthly payments & can possibly be lowered by protesting the value.

Here are instructions on how to protest online:

The main factor when disputing your value is "How does my home's appraisal (price per square foot) compare with other homes in my neighborhood"

First you need to look up the closest neighborhood streets to yours & compare (Google maps):

SQUARE FOOTAGE

POOL or NO POOL

LOT SIZE

ONE STORY / TWO STORY

Go to your county appraisal webpage and click on property search. You type the street name without numericals & it gives you all the homes on that street & their property's appraised value & more details.

HARRIS COUNTY: https://hcad.org/hcad-online-services/ifile-protest/

FORT BEND COUNTY: https://www.fbcad.org/appeals/

MONTGOMERY COUNTY: https://onlineappeals.mcad-tx.org/User/Login?ReturnUrl=%2f

BRAZORIA COUNTY: https://www.brazoriacad.org/e-file.html

IMPORTANT: Your county tax value is NOT used in the real estate sales market so it does not help or hurt your sales price. It's purely for taxes so letting it stay high does not help you.

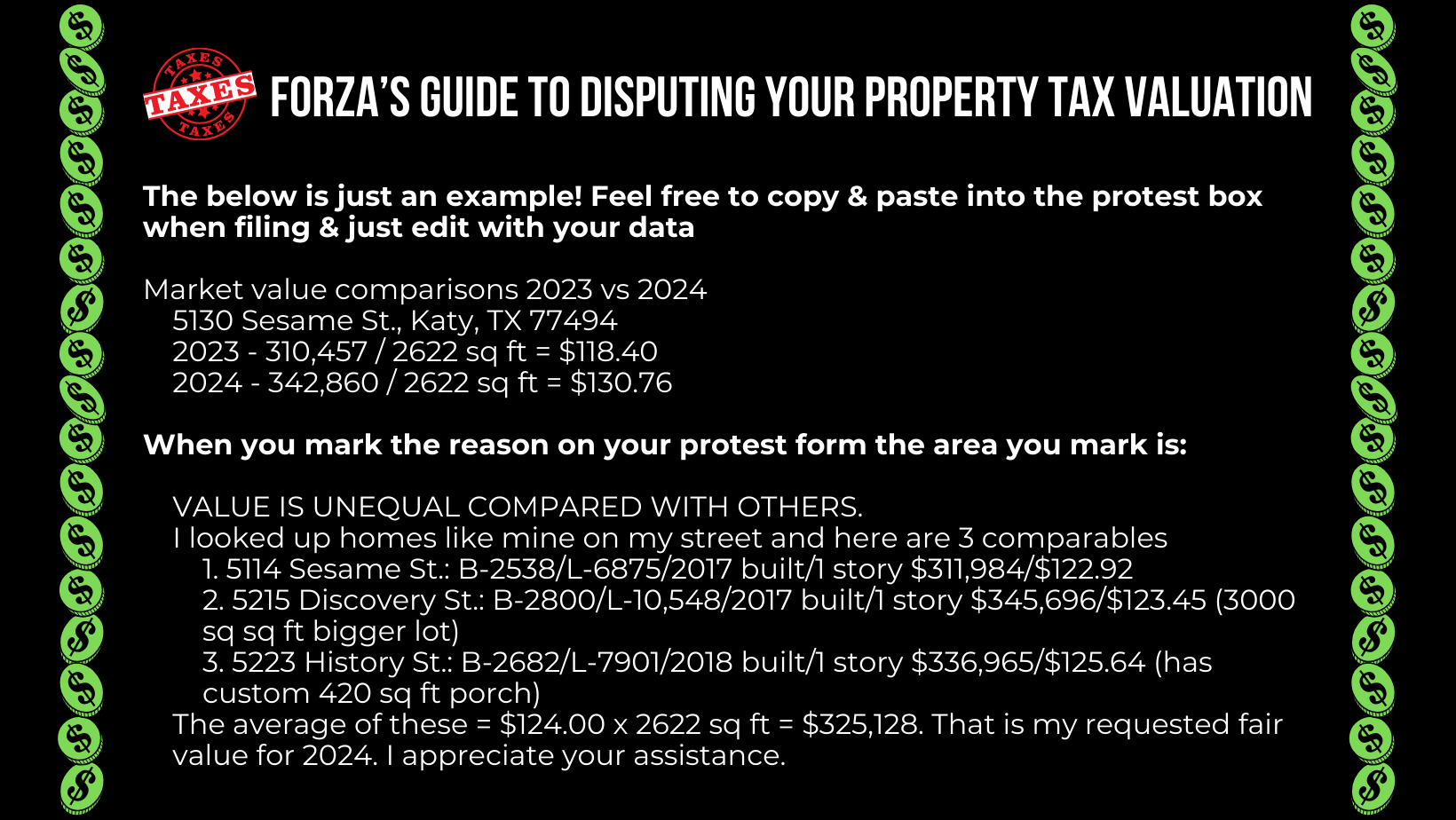

The below is just an example! Feel free to copy & paste the bold print into the protest box when filing & just edit with your data

Market value comparisons 2023 vs 2024

5130 Sesame St., Katy, TX 77494

2023 - 310,457 / 2622 sq ft = $118.40

2024 - 342,860 / 2622 sq ft = $130.76

When you mark the reason on your protest form the area you mark is:

VALUE IS UNEQUAL COMPARED WITH OTHERS.

I looked up homes like mine on my street and here are 3 comparables

1. 5114 Sesame St.: B-2538/L-6875/2017 built/1 story $311,984/$122.92

2. 5215 Discovery St.: B-2800/L-10,548/2017 built/1 story $345,696/$123.45 (3000 sq sq ft bigger lot)

3. 5223 History St.: B-2682/L-7901/2018 built/1 story $336,965/$125.64 (has custom 420 sq ft porch)

The average of these = $124.00 x 2622 sq ft = $325,128. That is my requested fair value for 2024. I appreciate your assistance.

Now back to you…

The current 2024 proposed $32,403 in higher value - 85% homestead rate (MUD doesn't provide homestead) = $27,542.55 x 3.1% tax rate = $853.82 estimated increase for 2024 year = $71.15 a month.

When you file your protest- less is more when it comes to talking or writing to them. The more you talk or type- usually ends up talking you into an even higher value. Again, the above is just an example. Feel free to copy & paste the bold print into the protest box when filing & just edit with your data. Typically this will be resolved online if you file online but you can also do this in person by completing their mailed form and going to the county appraisal officer personally.

Alternatively, the below are companies who specialize in Property Taxes listed on the Preferred Vendors page on forzarealestate.com

Property Tax Reduction

O'Connor and Associates

713-290-9700

Lone Star Property Tax

832-283-1602

AdValoremTax.net

281-957-9600